Mohit's Onboarding Project | JioFinance

Does your toothpaste have salt in it?

Does your financial app allow you to manage everything from one place?

Well, these are questions people will ask to ridicule you, but please don't be. After all, why do you want to track and manage all your finances from one place? Why would you want to ease your life by being able to invest and manage your expenses from a single app? Why would you want to be able to make payments and automatically track your spends across multiple categories? Lastly, why would you want to live stress free knowing you can be stressed by managing multiple things from multiple apps?

Well, if you're someone that finds the above verbatim strange, then we maybe heading somewhere. You see, while India is not a super-app preferring country, it is one where people feel jittered when it comes to managing their finances, and with new changes and apps coming out to ease your access to investments and expenses, they're most likely making it cumbersome with the requirement to manage multiple apps for multiple things. It's like roaming around with a wallet in the 21st century, consisting of 5 cards, 4 ID proofs, some coins, and that (weirdly constant) passport size picture you took in 2010.

Look closely, it's the same person, just that with JioFinance, he's gotten the time to talk to his full-time crush at his part-time job.

Look closely, it's the same person, just that with JioFinance, he's gotten the time to talk to his full-time crush at his part-time job.

This is where JioFinance is trying to place itself, right in the centre of the problem. Just before memes start pouring in on how Jio can disrupt everything, finance is a rather challenging one. With people settled in on payment apps like PayTM, PhonePe, and Google Pay, broking apps like Groww & Zerodha, it is difficult to move people from doing so, but I'm sure onboarding will make up for the effort.

About JioFinance

Jio Financial Services is a company focused on a host of financial services under the Reliance (Jio) umbrella, and is currently testing out their all-in-one financial app called JioFinance. It is aimed at being a financial super-app providing everything from Payment Aggregation facilities to Loans. Currently in their Beta testing stage, they've launched a pilot app on Play Store and App Store, whose onboarding teardown we will do further. The app manage your finance while you run on auto-pilot.

While Jio Financial Services is a rebranded version of Reliance Strategic Investments Ltd., the JioFinance app is a totally new offering they're bringing. Looking at their aim to launch a host of services together, JioFinance is looking to solve for a multitude of things aiming to bring UPI and Payments, Banking, Investments, Loans, Insurance, Broking and Personal Finance, and more under their umbrella.

Even though we see tonnes of apps already solving for the functionalities needed today (including super-apps like PayTM), here's how the industry is looking to fare out and why it makes sense for Jio to go bonkers:

- As of 2021, India was the 3rd largest FinTech ecosystem valued at about $50 Billion, poised to grow to ~$150 Billion by 2025.

- Valued at $270 billion in 2022, digital lending is set to rise to $350 billion by 2023. This surge highlights the transformative power of FinTech in democratizing access to credit.

- India stands as the second-largest InsurTech market in the Asia-Pacific region, poised to grow approximately 15 times and reach $88.4 billion by 2030.

- The WealthTech segment is riding the wave of a growing base of retail investors, predicted to reach $237 billion by 2030.

- Indian FinTech has the ability to solve for the underbanked and people requiring collateral-free loans, as the JAM trinity (Jan Dhan Yojana, Aadhaar, Mobile Connectivity) has helped bring new adults under the target net of financial inclusion.

Lastly, while all these are promising numbers for a specific sector under Finance, i.e., WealthTech, InsurTech, among others, just think about the opportunity when JioFinance tries to cater to all of it, all at once. But first, ICPs.

ICPs

Verbatim

- JioFinance is a pretty simple and well-rounded app, feels like there's finally just one app for everything finance, has made me switch from Paytm.

- I've always been using Zerodha universe along with GoDigit and G-Pay for managing my finances, but it was difficult to get my financial picture clear, and JioFinance looks promising.

- I can trust Jio and JioFinance with my money, whereas there has always been trust deficiency when it comes to new-age platforms, considering the recent Paytm debacle.

- Unlike other FinTech apps, it's simple and makes finance seem so too. But, I'm not sure if I should be changing everything that's preset.

- I don't think I can leave my current set of apps, because I like depth and specific apps can help with that, unlike these super-apps (JioFinance).

- For the past few years, I've struggled to manage finances as I was running between multiple apps and things to understand my issues, and JioFinance looks simple to navigate, but I'm not sure if I'd have as many choices as before.

The verbatim listed was noted from multiple exhibits (information unlinked for their privacy) who downloaded the app (after me pestering them to), took some time to explore the app and finally gave me their take on it!

Profiles

Profile/Details | ICP 1 | ICP 2 | ICP 3 |

|---|---|---|---|

ICP Icon | 👨🎨 | 👸 | 👨💻 |

ICP Name | Financially Clumsy | Financially Rational Buff | First Internship/Job Phenomena |

Age (in years) | 18-30 | 22-45 | 17-23 |

Gender | Male | Female | Male |

Income Level (in INR Lakhs) | 7-30 | 5-60 | 1-7 |

Location | Metro & Tier 1+ Cities | Metro & Tier 1+ Cities | Metro & Tier 1+ Cities |

Occupation | Job | Job/Business/Self-employed | Job |

Marital Status | Unmarried | Unmarried/Married | Unmarried |

Where do they spend their time? | Online: Social Media (X, Instagram, Snapchat), OTT & Video Streaming (YouTube, Netflix, Prime Video), Sports, Communication (Mail, WhatsApp). Offline: Restaurants & Clubs, Theatres, Gym, and Malls. | Online: Social Media (X, Instagram, Snapchat), OTT, TV, & Video Streaming, E-learning (Udemy, Coursera), Communication, E-commerce (Meesho, Flipkart, Amazon, AJIO, Myntra) Offline: Restaurants & Clubs, Markets (Grocery, Clothing, etc), Theatres, and Malls. | Online: Social Media (X, Instagram, Snapchat), Offline: Restaurants & Clubs, Theatres, Gym, |

Where do they like to spend their money? | Entertainment, Fitness, Learning, and Experiences. | Entertainment, Shopping, Learning, and Experiences. | Entertainment, Shopping, and Experiences. |

Requirements from FinTech Apps | Simplify managing finances, run investments on auto-pilot, without worrying about spends. | Help in getting maximum returns with daily spends, without having to break their head over it. | Be able to save as much as possible, but also get |

Pain Points | Difficult to keep track of the spends (while spending), managing multiple investments (exit and entry is not | Difficult to keep track of investments, and issues in accessing important things at the right time, i.e., no structure for loans/insurance, using them. | Unable to save from the pocket money/stipend/salary |

Current Solution | Allocate amounts to investments, savings and expenses, and use multiple apps for their use cases. | Plan their finances monthly, and manage all their finances through multiple dashboards. | Use a payment app for payments and tracking |

| | | |

Most valuable feature of JioFinance? | Finance Tracker and Manager | Payments & Insurance Options | My Money |

Frequency of using JioFinance | Daily | Weekly | Daily |

Money spent via JioFinance | >Rs.5,000 | >Rs.30,000 | ~Rs.1,000 |

Time vs. Money, what's important to you? | Time | Time | Money |

How frequently do you make payments? | Everyday | Every 2 days | Everyday |

Do you invest/insure/loan seriously and frequently? | No | Yes | No, but want to start. |

In general, what's your take on JioFinance? | It is trying to bring new features to simplify finances, but I'm guessing other startups will catch-up too. Nothing significant according to me. | It looks promising because of its simple interface and important features, unlike other apps which are cluttered. One apprehension of a mandated Jio sim is false, so don't know how they'll create this universal identity for themselves. | It's a new app to try, but with so many options |

Prioritisation

Prioritisation Metrics | ICP 1 | ICP 2 | ICP 3 |

|---|---|---|---|

Adoption Curve | Low | Low | Low |

Frequency of Use Case | High | High | High |

Appetite to Pay | Medium/High | High | Low |

Distribution Potential | Medium | High | High |

User Goals (JTBD Framework)

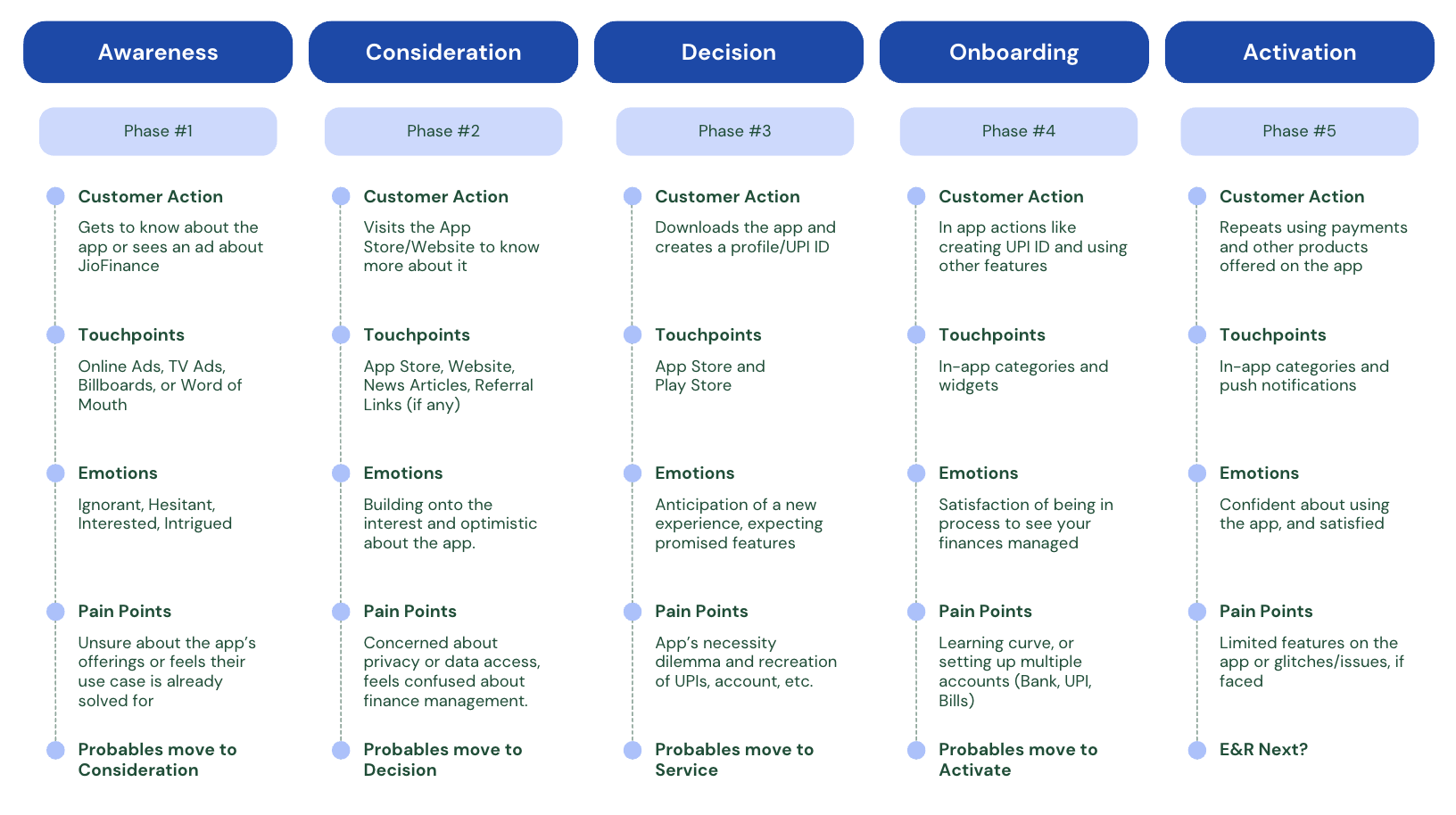

Customer Journey Map

User Goals

The users opting for JioFinance may intend to use it for rewards and cash backs (as they did for other apps initially), however, serious paying users can be found opting it to manage their finances well from a trusted and single-point solution. With this in mind, the user goal this product strongly attributes to is Personal Goal. There's however, a secondary element of Functional Goal, to have finances managed on auto-pilot without having to stress about managing multiple things from multiple apps frequently.

Onboarding Teardown

JioFinance - Onboarding Teardown.pdf

Some cognitive biases which can be evidently seen are Progressive Disclosure and Priming, across the information and login screens.

Overall Metrics to Track & Activation Hypotheses

Basis the teardown, and other functionalities seen on the app, a few activation hypotheses that can be relevant in this case are as follows:

- 10 Payments in 5 Days - The basis for this hypothesis is that 10 payments on the app in 5 days would mandate the user to create and setup their UPI ID, and when payments are made frequently using the app, the user can switch or alternate across other financial apps, which creates JioFinance as an option.

- Linking 1 Bank Account in 2 Days - As seen in the My Money tab or by the app's initial promise of being able to manage all your finances and control it all, linking their bank accounts (or creating one on Jio Payments Bank) is the most crucial step, which if done in under 2 days, can activate a user, as they would timely check the app for bill payments or their financial picture.

- DAU/MAU - 1 app session a day or 25 sessions in a month is an ideal activation metric, considering payments are a daily activity. However,

- Average TAT - While a very ideal TAT is under 5 minutes, usual customers who might explore the app can take upto 15-20 minutes. Tracking and decreasing this can help lock more users in the ecosystem faster.

- Feedback Loop / CSAT - A qualitative metric of feedback loop or in-app CSATs is ideal and if a customer actions on this 1-2 times, it can be considered an activated user. The hypothesis stems from the fact that an app in the Beta status receiving feedbacks shall tag the user as "concerned", rather activated. A CSAT similarly can reinforce positive experience from the user.

Final Thoughts

After spending sometime to understand the nuances of people's requirements and how they manage their finances, there seems to be a good momentum ready for JioFinance to tap into, however, there are always serious considerations to be made for JioFinance from the current market solutions.

While their 1-stop finance shop boasts (or is trying) to solve for simplifying and managing finances, it remains a challenge for a super app in India to be established, as Indians prefer specialised apps and services for different needs. For example, there's Zomato for food delivery and BlinkIt for instant gratification needs and it's working wonders for them, unlike Swiggy, where the user's purpose is not clearly defined across Food, Grocery, Genie, Dining, etc., though it works.

Similarly, if JioFinance gets to become a Swiggy or Paytm for Finance, then there might be space for them to sustain well in the market, but the odds of it becoming a Tata Neu are 50:50 too, isn't it?

fin.

Brand focused courses

Great brands aren't built on clicks. They're built on trust. Craft narratives that resonate, campaigns that stand out, and brands that last.

All courses

Master every lever of growth — from acquisition to retention, data to events. Pick a course, go deep, and apply it to your business right away.

Explore courses by GrowthX

Built by Leaders From Amazon, CRED, Zepto, Hindustan Unilever, Flipkart, paytm & more

Course

Advanced Growth Strategy

Core principles to distribution, user onboarding, retention & monetisation.

58 modules

21 hours

Course

Go to Market

Learn to implement lean, balanced & all out GTM strategies while getting stakeholder buy-in.

17 modules

1 hour

Course

Brand Led Growth

Design your brand wedge & implement it across every customer touchpoint.

15 modules

2 hours

Course

Event Led Growth

Design an end to end strategy to create events that drive revenue growth.

48 modules

1 hour

Course

Growth Model Design

Learn how to break down your North Star metric into actionable input levers and prioritise them.

9 modules

1 hour

Course

Building Growth Teams

Learn how to design your team blueprint, attract, hire & retain great talent

24 modules

1 hour

Course

Data Led Growth

Learn the science of RCA & experimentation design to drive real revenue impact.

12 modules

2 hours

Course

Email marketing

Learn how to set up email as a channel and build the 0 → 1 strategy for email marketing

12 modules

1 hour

Course

Partnership Led Growth

Design product integrations & channel partnerships to drive revenue impact.

27 modules

1 hour

Course

Tech for Growth

Learn to ship better products with engineering & take informed trade-offs.

14 modules

2 hours

Crack a new job or a promotion with ELEVATE

Designed for mid-senior & leadership roles across growth, product, marketing, strategy & business

Learning Resources

Browse 500+ case studies, articles & resources the learning resources that you won't find on the internet.

Patience—you’re about to be impressed.